The adaptation finance landscape: Why adaptation finance should be additional to traditional aid

Written by Janto S. Hess

The parties to the United Nations Framework Convention on Climate Change (UNFCCC) agreed in 1995 to financially support developing countries for costs of damage caused by climate change. The Article 4(3) of the convention mentions providing ‘new and additional funding’ (Mace 2005: 226). However, several studies point out that Official Development Aid (ODA) has often been declared as Climate Change Adaptation (CCA) funding by donor countries (Nakhooda et al. 2013a, Klein and Möhner 2011). Klein (2011) argues that there is no common definition of what ‘new and additional’ means, which makes it difficult to prevent double-counting. Other studies point out that the distinction between CCA and ODA measures are difficult as they are too interlinked with each other (Jones et al. 2012, Mercer 2010, Roberts et al. 2010). Furthermore, scholars have proposed to separate CCA funding schemes more clearly from existing ODA in order to increase developing countries’ autonomy as recipients of financial support (Roberts et al. 2010, Oxfam 2009).

In this article I will critically analyse the current situation of CCA finance, investigate critical aspects of the current CCA funding landscape, and where eligible, provide better solutions to handle CCA funding. All of these insights will lead to conclusions about whether or not ODA should be used for CCA.

Definitions

The Development Assistance Committee (DAC) defines ODA as “those flows to countries and territories on the DAC List of ODA Recipients and to multilateral institutions which are: i. provided by official agencies, including state and local governments, or by their executive agencies; and ii. each transaction of which: a) is administered with the promotion of the economic development and welfare of developing countries as its main objective; and b) is concessional in character…” (OECD 2013b). CCA is defined by the IPCC as the “adjustment in natural or human systems in response to actual or expected climatic stimuli or their effects, which moderates harm or exploits beneficial opportunities” (Rogner et al. 2007). The problem with this definition lies within the unclear distinction to other measures, e.g. installing early warning systems for floods as a Disaster Risk Reduction (DRR) intervention (Mercer 2010).

The current adaptation finance landscape, an overview

The adaptation financing landscape consists of a range of public, private, and international financial backers. At the seventh Conference of the Parties in 2001, three major funds with a specific mandate in relation to adaptation were implemented (Ayers 2009): the Least Developed Countries Fund (LDCF) and the Special Climate Change Fund (SCCF), both under the Global Environment Facility (GEF), and the Adaptation Fund (AF), under the Kyoto Protocol. The AF is unique in its democratic governance structure as it has its own independent board and special seats for developing countries and Small Island Developing States (Ayers 2009). In contrast, the managing board of the GEF is donor country dominated (ibid.). A further distinction lies in the sources of finance; whereas the LDCF and the SCCF rely on voluntary contributions from developed countries, the AF is partly financed from a levy on the Clean Development Mechanism (CDM) (Klein 2011). Another emerging fund that is likely to become the centrepiece of climate funding is the Green Climate Fund under the UNFCCC, which was intended to become operationalized in 2013 (Nakhooda et al. 2013b). However, no financial resources have been pledged to the fund so far (ibid.).

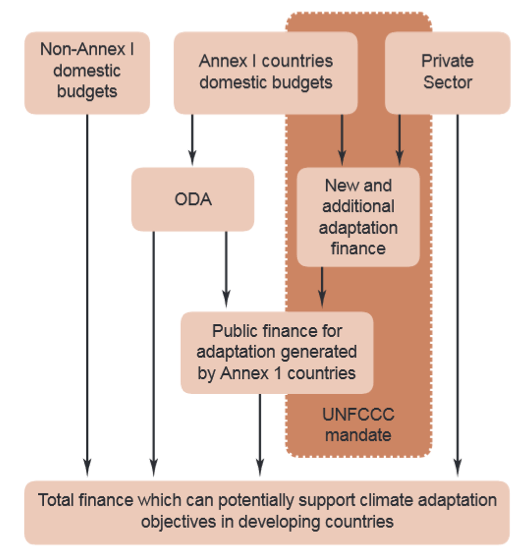

Additional to these funding schemes, there are bilateral and multilateral development support (e.g. the World Bank’s Pilot Program for Climate Resilience), private-sector contributions, and investments of developing countries themselves (see figure 1).

Figure 1: Overview of adaptation funding channels (source: Klein 2011)

Climate Funds Update (CFU) calculated that USD 2.17 billion has been pledged by developed countries to multilateral adaptation funds and USD 2.8 billion has been approved for CCA projects since 2003 (Climate Funds Update 2013c, 2013a). Table 1 shows the four main adaptation funds. 77% of these funds are provided by the United Kingdom, the United States, Germany, Canada, Sweden, and Japan (Caravani et al. 2013). The ‘West’, therefore, has the biggest influence on the LDCF and the SCCF decision-making processes.

Table 1: Funds exclusively supporting adaptation 2003-2013 (source: Caravani et al. 2013)

In contrast to the adaptation funds the overall ODA was significantly larger and totalled USD 125.6 billion net ODA in 2012; representing 0.29% of the mean gross domestic incomes (GDI) of the donor countries (OECD 2013a). However, still considerably low compared to the self-declared target of allocating 0.7% of donor countries’ GDP (that is met by only five countries) (Klein 2011).

Opposing perspectives and challenges in differentiating between ODA and CCA

The following part of this post will explore some possible challenges to CCA funding, arguments in favour, and against using ODA to finance CCA measures.

Contrasting perspectives between developed and developing countries create a major challenge for efficient CCA funding. Klein (2011) states that the interpretation of transparency, equity, and accountability is fundamentally different. Many developing countries see climate adaptation finance as an entitlement and something that “should be considered as an obligation for those who caused the emissions historically” (IRINnews 2011). Furthermore, developing countries insist that the funds are ‘new and additional’ to the 0.7% of the self-commitment, because of the concern “that aid would otherwise be diverted away from crucial needs such as healthcare, education, agriculture and safety” (Roberts et al. 2010: 1). A difficulty lies within the fact that there was no determined baseline year from which the funds would be additional and how such a baseline would be set (Roberts et al. 2010). Developed countries, in contrast, interpret ‘new and additional’ funding often “as those going beyond current financial flows, and they consider ODA as a possible component of these resources” (Klein 2011: 2).

These different perspectives and the fact that former promised financial support has not always been delivered shows the importance to monitor and track adaptation funding, and set a clear and commonly accepted baseline of what is being ‘new and additional’ to differentiate CCA from ODA.

Another challenge for differentiating CCA from ODA funding schemes lies in the unclear distinction of what can be accredited as CCA interventions, as many measures could be double-declared and are difficult to separate. It can be said that the vulnerability of a country, which ODA interventions intends to decrease, depends on the adaptive capacity towards climate-related hazards (Ayers 2009). Roberts et al. (2010: 2) argue that “many of the actions taken to prepare for climate impacts are identical to those many countries have been putting into practice for years”. These overlapping interventions can for example be diversifying economies, building irrigation systems, or DRR measures in a broader sense (ibid.). Mercer (2010) pointed out that DRR actions can be theoretically distinguished from CCA measures in many aspects, but that they merge in practice. Therefore, many CCA funds are being used for DRR measures, for example for improving early warning systems, as DRR projects often lack funding from traditional ODA (Kellet and Caravani 2013, IRINnews 2011). In 2011, 70 out of 130 approved CCA projects were partially DRR focussed, while 17 targeted risk reduction directly (Kellet and Caravani 2013). This overlap between CCA and ODA projects makes it significantly difficult to assess the additionality of funds and categorise interventions. Currently, donors define their own projects as climate-related or not under the OECD DAC system (Roberts et al. 2010). This leaves space for interpretation of the coding. Nakhooda et al. (2013a) determined that eighty percent of the Fast-Start Finance (FSF) was also reported as ODA by donor countries. Criticism has been raised that executing staff assigning codes “are often overworked and under-resourced, and may be under pressure to determine spending in each category to satisfy the ‘new and additional’ criterion” (Roberts et al. 2010: 3). Other scholars declare the “methodologies for coding and tracking adaptation finance [as] … inadequate” (Jones et al. 2012: 2).

This evidence indicates that ODA is and always has been used for CCA and vice versa. Some scholars argue that supporting adaptation through development is only rational (Dodman et al. 2009). However, the distinction and coding of measures seems to merge in many aspects and to such a degree that categorising them in practice appears nearly impossible. There are suggestions to create better ‘Adaptation Markers’; a categorising system for adaptation measures based on the ‘Rio Markers’[1] system (IRINnews 2011, Roberts et al. 2010). However, it has proven to be difficult to distinguish the types of adaptation activities making this approach hard to realise (Jones et al. 2012, Roberts et al. 2010).

Why official development aid should not be used in climate change adaptation

One argument for differentiating ODA and CCA funding is that the overall amount of finance for adaptation could increase. Montes (2012) and Ayers (2009) pointed out that levels of funding are generally insufficient to meet the needs of developing countries. They argue that funding for CCA on a voluntary basis, as is common for ODA, is unlikely to ever generate adequate amounts, considering that contributions tend to be additional to any current ODA or even the 0.7% commitment most countries fail to provide. According to Montes, representing the UNFCCC, existent funding covers only a fraction of what is needed. He estimated the need for adaptation funding for developing countries to be between USD 100-450 billion a year (Montes 2012). Generating part of this needed funding could be reached via committed finance, for both mitigation and adaptation, under the UNFCCC. Developed countries agreed upon providing USD 30 billion, from 2010-2012, (known as ‘Fast-Start Finance’[FSF]) as a step towards mobilizing USD 100 billion per year from private and public sources by 2020 (Nakhooda et al. 2013a). According to the self-reporting of contributors to the FSF countries the targeted funding was exceeded (Nakhooda et al. 2013a). However, a significant part of the FSF was double-declared (ibid.). Therefore, defining a baseline for what is ‘new and additional’ and which measures can be considered as CCA combined with separated funding schemes can increase the overall amount of funds available for adaptation.

Another beneficial aspect of differentiated funding schemes lies within government structures of adaptation funds. GEF managed CCA funds came under criticism from scholars and Non-Governmental Organizations as providing unclear guidance and high transaction costs (Ayers 2009). Oxfam argued that “reliance on bilateral aid channels, and the lack of effective developing country representation within multilateral governance structures means that adaptation is not demand-led, but instead is driven by donor priorities” (IRINnews 2011). Furthermore, available funds are insufficiently disbursed and delivered funds are difficult to monitor in a chaotic and complex funding landscape (IRINnews 2011, Roberts et al. 2010). In contrast, the AF was praised for its more equal decision making approach. Developing countries hold eleven out of sixteen seats on the managing board and have the majority in formal voting (Trujillo and Nakhooda 2013). Furthermore, the AF is known as being fast in disbursing money once a project is approved, highly transparent, and involves the civil society in formal and informal ways (ibid.). However, the innovative funding scheme of sources from the CDM and donors appear to be unpredictable (see figure 2) and the fund was significantly reliant on developed countries contribution (Trujillo and Nakhooda 2013: 7). It can be assumed that these funding problems and the general small scale of funded projects undermined the recognition of this alternative governance approach. Nonetheless, the AF scheme appears to be promising and raises the developing countries autonomy in CCA funding.

Figure 2: Certified Emission Reductions monetisation (CER) and voluntary donations to the AF (figures in USD million) (sources: Climate Funds Update 2013c, Adaptation Fund Board 2012)

A range of ideas have been discussed of how to generate sustainable funding schemes that are not reliant on developed countries’ donations. Schultz (2012) suggested a market-based vulnerability reduction crediting mechanism, comparable in its function of the CDM and based on the polluter pays principle. However, this kind of mechanism would need an international acceptance of the polluter pays principle, which has been rejected by several developed countries (ibid.). Other suggestions were to extend the two percent levy on CDM transfers to generate more funding or to create an International Air Travel Adaptation Levy and a levy on maritime bunker fuels through an International Maritime Emissions Reduction Scheme (Ayers 2009) .

All these suggested approaches could increase the autonomy of CCA fund receiving countries and generate money independently from developed countries. Furthermore, major polluting industries and sectors could be made responsible for financing CCA.

Conclusion

In conclusion it can be said that opposing perspectives from developing and developed countries in setting a commonly accepted baseline of what is ‘new and additional’ and a lack of clear coding to differentiate CCA from ODA measures create significant barriers to distinct ODA and CCA funding. However, resolving these issues and using ODA for CCA would include several disadvantages for finance receiving countries. Current governance structures of ODA funds, as applied in the GEF, undermine the autonomy of developing countries and leave the decision making authority with the donor countries. Another concern is that the additionality of CCA funding is weakened if traditional ODA streams are used to finance adaptation. Therefore, ODA should not be used to finance CCA. In contrast, making the private sector financially accountable for adaptation appears to be the best way to increase ODA’s independent funding and, therefore, enhance the developing countries influence on the governance of CCA finance.

[1] Rio markers were established by the DAC to track aid flows for climate change mitigation (FNR-Rio 2013).

© Janto S. Hess

Suggested citing:

Hess, J. S., 2014. The adaptation finance landscape: Why adaptation finance should be additional to traditional aid [Online] Available at: https://climate-exchange.org/2014/02/18/the-adaptation-finance-landscape-why-adaptation-finance-should-be-additional-to-traditional-aid [accessed + date when the website was accessed].